Lesson Five - Introduction to Estate Planning

The Need for Estate Planning

This section is intended for people who own woodlots and want to plan for the future. It will help owners develop a clear plan of how to pass the woodlot on to a spouse or a child.

Often people pass away without making plans for the future. This can cause confusion and sometimes legal or other costs at a difficult time for the family. Sometimes it can result in significant taxes being due from the estate that might otherwise be reduced or avoided.

For these reasons, estate planning is essential. We will explain estate planning for woodlot owners in a general way and will not deal with all situations; rather we will only deal with the most common situations and problems that you might encounter. We will outline the background of estate planning and explain terms. We will also discuss various strategies that may reduce taxes on death. Planning now can make your wishes happen when you are gone.

The Estate Planning Team

Estate planning can be complex, and ensuring the plan is properly implemented is crucial to its effectiveness. Assistance of several professionals may be required, including a lawyer, an accountant, a financial planner, and an insurance agent. It is important the individuals that you select have a solid expertise in estate planning. Some questions that you may wish to ask potential advisors would include, but are not limited to:

- Do they have a professional designation or a relevant degree?

- What is their experience – how long have they been practicing estate plans?

- Have they put into practice estate plans with similar complexity to yours?

Time and money will be saved if you are able to gather all the necessary materials before you visit an advisor or begin to plan the estate. The following is a list of materials you should have:

- family details: age, marital status, involvement in woodlot or other business interests

- current will if you have one

- list of assets: cost, (V-day value if applicable), and market value

- any appraisals or other valuation information

- list of liabilities: amounts, security given, and repayment terms

- details of form of ownership of assets: personal, corporate, partnership

- financial statements and tax returns for several years

- details of life insurance policies

The Estate Planning Process

SETTING OBJECTIVES

The starting point for any estate plan is to determine your objectives. You need to know where you want to go before you can develop a plan to get there. As the planning process unfolds, it will become clear what you can and cannot do. It will also become clear that you may need to modify some of your objectives. But you should start with a general idea of what you want to do.

The first objective of most estate plans is to provide adequate cash flow to your spouse or any dependents. Other common objectives are to maintain family ownership of a particular asset such as a family business or a woodlot, or to have the ecological features of the woodlot preserved by donating it to, or granting an easement to, a conservation authority.

Most people are concerned that they treat their children equitably, or fairly. Equitably does not necessarily mean equally. You do not have to subdivide your woodlot so each of three children gets a small woodlot of their own. And, it makes little sense to transfer a woodlot to a child who has no interest in managing it - especially if another child does. Equitable treatment might involve leaving the woodlot to one child and cash or life insurance to another.

List your estate planning objectives below:

1.

2.

3.

4.

LISTING ASSETS

LISTING ASSETS

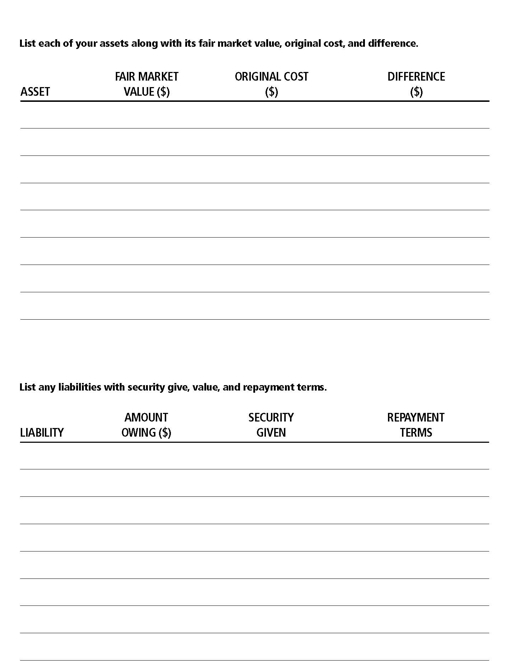

To plan your estate you have to know what it will consist of. You need to make a list of all of your assets. Some things, such as household effects, can be grouped by type. But any asset that might be disposed of individually should be listed individually. A woodlot, for example, would be listed individually.

As well as identifying the assets themselves, you need to estimate the fair market value of each one. In some cases it is worth getting formal valuations or appraisals but in many others you can make a reasonable estimate yourself. Knowing the value of your assets makes an even-handed distribution of your estate easier. It also makes it easier to estimate the taxes payable.

It is important to list the original cost of the assets. This is used to calculate the tax liability. This information can be difficult to find, so the estate planning process is a good opportunity to create an accessible record.

Listing Liabilities

Your estate consists of your assets minus your liabilities. For older woodlot owners, taxes may be the only significant liability, but, for younger people, that may not be the case. They may have mortgages on land, or still owe money on equipment. Part of the process of planning your estate is to develop a plan to deal with your liabilities at death.

Developing and Implementing the Plan

With this information, you are ready to develop a working plan. Modify your objectives as it becomes clear what is practical and rework the plan until it meets your needs and wishes.

Information about things to consider when planning your future can be found in Lessons Two, Three and Four. You should refer to this information when developing your plan.

Implementing the plan often just requires a fairly simple will. More complex situations might require the formation of trusts or corporations, reorganizing existing corporations, acquiring life insurance and so on.

It is important to periodically review your plan, as family situations, assets held, and objectives change over the years.