Module 10B: Introduction to Woodlot - Income Tax and Estate Planning

Lesson Eight - Other Things to Consider When Planning Your Future

The Need for Long-term Care

You may, particularly later in life, require long- term care services. These services could be provided at home or in a residential facility such as a nursing home or special care home. They can be very expensive. If you are unable to pay for these services yourself you may receive assistance from the Department of Health.

The Provincial Department of Health determines whether or not you are eligible for financial assistance for the costs of long-term care by performing an income-based financial assessment using your most recent income tax information. The financial assessment will take into account the fact that if you have a spouse, they will need a portion of the income to maintain their lifestyle. Your spouse is able to keep 50 percent of the family income and maintain all assets.

If you harvest and have business income or a capital gain from your woodlot, this will affect the income test. For example, if you have a large one-time capital gain from the sale of your woodlot the year you need long-term care, you may not qualify for financial assistance. However financial reviews are done annually and you may be eligible in the following year.

Donating Your Woodlot to Charity

You may benefit a charity by donating your woodlot to it. Donation of land to a conservation authority is of particular interest to woodlot owners, but donations can be made to other charities as well. You could also donate a conservation easement to a conservation authority rather than the whole property.

A gift is a disposition. With one exception, which we will discuss later, the deemed (assumed) proceeds of disposition will be the fair market value of the property donated. This can result in a capital gain.

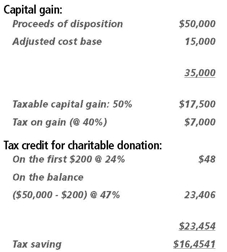

The deemed proceeds of disposition are treated as the amount of the charitable donation. The charitable donation earns a tax credit. The first $200 of charitable donations earn a credit at the lowest tax rate, about 24% in Nova Scotia, and the rest earns credit at the top rate, about 47%.

The amount of donation that can be used for credit in any given year is equal to 75% of your net income plus 25% of any taxable capital gain that results from a charitable donation. This ensures that all of the capital gain will be eligible for credit in the year the donation is made. Any unused amount can be carried forward for five years.

Donating a woodlot to charity produces a tax saving since only 50 percent of the capital gain is taxed, while 100 percent of the value of the woodlot at the time of transfer earns credit as a donation. This can be a big advantage, especially if you have unused capital losses that can shelter the capital gain from tax.

Example. Susan has a net income of $60,000 and donates a woodlot worth $50,000 to charity. Susan originally purchased the woodlot for $15,000.

1. The credit cannot exceed Susan’s actual tax, which will be less than $23,454 due to graduated tax rates and other credits and deductions. Therefore some of the donation would have to be carried forward and used to reduce tax in future years. You have up to five years to claim the tax from a donation.

Exercise 7

Danny donates 40 acres of land worth $25,000 to a registered charity. The total 100 acre woodlot cost him $40,000 when he purchased it. Assuming the 40 acres donated was worth 2/5 of the purchase price when he bought it, what are the tax implications of the donation? Assume a marginal tax rate of 40%.

(see exercise 7 for answer)

A donation of a woodlot to a charity could be made during your lifetime or it could be made by way of bequest in your will.

Gifts of Ecologically-Sensitive Land

Your woodlot may qualify as a gift of ecologically-sensitive land – also known as an eco-gift. These are gifts of land that have been certified by the federal Minister of the Environment as important to the protection of Canada’s environmental heritage. The gift must be made to a public charity that is designated by the federal Ministry of Environment. In order for the land to meet the qualifications, it must have natural features, wildlife habitats or other heritage values. In addition, the land has to be certified by the Ministry of Environment as ecologically sensitive.

By gifting a qualified woodlot, you receive a tax receipt for the fair market value of the woodlot on the day of the transfer. The benefit of this program is that there is no capital gain on the disposition. The tax credit is limited to your annual income and has to be used within five years.

Using the same example as before, but now assume the land Susan donates is ecologically-sensitive land. The full tax savings of $24,454 would be realized, without the tax on the gain.

Probate Fees

In most cases, the executor will want to have the will probated. That means the courts will review the documentation to determine whether it is valid and allow the executor to follow the directions given in the will. This gives the executor a better legal status to deal with some aspects of the estate and some confirmation that they have acted appropriately.

The schedule of fees payable to probate a will in Nova Scotia is as follows:

Probate fees are based on the value of the estate, so if the estate value can be reduced, the fees will be reduced. There are several ways to do this.

As was noted earlier, life insurance can be made payable to your estate. This increases the estate, so it is more typical to name a specific person or persons as beneficiary.

Real property held in joint tenancy passes directly to the survivor without going through the estate. Spouses commonly hold the family home and bank accounts jointly. Joint ownership may exclude an asset from the estate for probate purposes, but will not avoid income taxes if the asset really belongs to only one spouse.

Transferring assets to a trust will also remove them from the estate and avoid probate fees. As we discussed earlier, this is quite complex and may not be suitable in many cases.

Power of Attorney

Before your death, you may become incapable of managing your affairs. Your family can get permission from a court to manage them, but this is a costly, time-consuming process. It is better to give someone a power of attorney. This is a document that gives them the right to manage your affairs, or certain aspects of them, if you become incapacitated. It requires legal advice, and should not be left too late.