Module 10B: Introduction to Woodlot - Income Tax and Estate Planning

Lesson Three - Measuring Income

Record Keeping

Anyone carrying on a business is required by law to maintain books and records so that they can determine income and what taxes they must pay. They must also keep records documenting the calculation of payroll taxes, HST, workers’ compensation, and so on. Keeping books and records generally centres on the bank account. As a rule, corporations and partnerships have a separate bank account through which the business transaction would flow. Although not legally necessary, record keeping for a proprietorship is much simpler if a separate bank account is kept for business transactions.

Record keeping systems are available to suit all levels of complexity. Generally they are designed to document and summarize revenue and expense transactions, and to keep a financial record of investments in assets and business liabilities.

Electronic record keeping through an off-the-shelf package is most common and not difficult to learn if you have basic computer skills. It is less prone to error and simplifies the record keeping process.

A basic manual record-keeping journal is shown in Appendix 4. You enter financial details of business transactions in a multi-column journal, often called a cashbook, as the cash is received or disbursed. You keep separate columns or accounts for each category of receipt or disbursement that is regular or large. This makes it easy to summarize accounts and prepare financial statements from time to time. Cashbooks are available with many columns and, if necessary, the receipt and disbursement transactions may be kept in separate journals.

In this basic manual system, you would keep an “open item file” for accounts receivable invoices and a separate one for accounts payable invoices. When preparing financial statements, you would take listings for businesses using the accrual basis and make appropriate adjustments for these unrecorded invoices. Other adjustments would also be made for unpaid wages and other liabilities as well as inventory levels.

A new cashbook should be used for each fiscal period. It should be totalled and balanced from time to time - preferably monthly - and ideally posted to a general ledger, which keeps a more permanent record of the business accounts. Regardless of the size of the business, it is important to compare and reconcile the transactions in the cashbook with those on the business bank statements. As business activity grows, you can upgrade to a more sophisticated manual record keeping system. However, a computer system will probably be the practical solution over the longer term.

Although a basic cashbook and general ledger work well to document and summarize transactions, you must also keep the supporting documents themselves - contracts, expense invoices, revenue invoices, deposit slips, bank statements and cancelled cheques, etc.

Canada Revenue Agency Requirements

The Canada Revenue Agency will allow the following methods of record keeping: - books, records, and supporting documentation prepared and kept in paper format

- books, records, and supporting documents prepared on paper, and later changed to and stored in an electronically accessible and readable format, such as a PDF file

- electronic records and supporting documents prepared and kept in an electronically accessible and readable format.

CRA does not specifically tell you what needs to be kept, but your records have to be reliable and complete, provide the appropriate information needed to determine your tax obligation, be backed up by original documents for verification of transactions, and include additional documents that help to determine tax obligations, such as appointment books, mileage logs, GST/HST returns, and so on. In addition to this, if your business is incorporated CRA requires you to keep any minutes of meetings held, record of a corporation that includes information relating to ownership of shares, general ledgers that summarize the transactions of each year, and special agreements needed to back up the entries in the general ledger if they are difficult to understand.

Per CRA, the general rule is to keep all records and supporting documentation, whether in paper or electronic format, for a period of six years from the date CRA assesses your tax return. You should note that if you use computerized systems to generate records, you must keep the electronic records, even when a hard copy is kept. Documents dealing with items of a long-term nature that would affect eventual sale or wind-up of business should be kept indefinitely. Examples would be loan documents, equipment purchases, share registry etc.

Accounting documents may be destroyed earlier if you have received permission from the CRA in writing. Even then, be cautious, as CRA’s blessing will not influence other government agencies such as workers’ compensation authorities.

The records and books of account must be located at the place of business or at another place designated by the Minister of Finance and must be made available at all times to officers of the Minister for audit purposes. Penalties may be imposed by CRA if adequate records are not kept, you do not give officials access to your books when requested, or you do not provide information to officials when asked. In addition expenses may be disallowed if you cannot provide supporting source documents. These fines can be large and therefore it is advisable to keep well-organized records.

Receipts/Revenues

Businesses normally generate their cash flow from one or two main sources, so the variety of cash receipts that a business must account for may be small. It is often helpful when managing a business to have a more detailed breakdown of these revenue sources, but there is no requirement to do so. A woodlot operator may want to track revenue from hardwood and softwood sales separately, for instance, or keep cedar and spruce sales separate, or track revenue from one woodlot separately from another.

If you need such a detailed breakdown, it can easily be handled with the record keeping system outlined above by adding the appropriate columns to the cashbook. Nevertheless, most cash receipts could be accounted for under the following headings:

- sales revenue/collection on account

- HST collected

- miscellaneous income

- loans received

- other receipts (e.g. equipment sales or trade-ins, advances from shareholders, HST refunds, income tax refunds, and so on)

- Sales revenues, sundry income and equipment sales are all relevant in determining taxable income.

Expenses

For a woodlot operation not carried on as a farming business, income must be reported using the accrual method. Generally speaking, expenses directly related to the commercial activity are deductible in the year incurred.

Capital costs

Payments on capital assets cannot immediately be deducted for income tax purposes. This is true regardless of whether the taxpayer calculates income using the cash basis or the accrual basis of accounting. Capital assets tend to be of a long-term nature and provide an enduring benefit. Examples include land, buildings, automotive and other equipment (such as motor vehicles, tractors, chainsaws, winching equipment, skidders, etc.), fencing, timberland, etc. Generally, equipment or tools that will be of use for more than one year are considered capital assets and are depreciated over the long term for income tax purposes.

For practical purposes, an immediate write-off is allowed for a tool costing less than $300. Note that an item that may appear by itself to be a capital item may be deductible as a repair if it is in fact a replacement part or component for a larger piece of machinery. Inventory (such as seedlings and plantations, see below) is not considered a capital asset and neither is the cost of supplies that are consumed in the business.

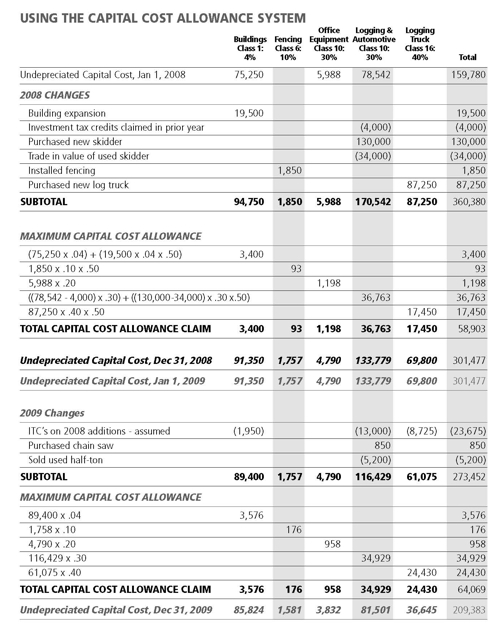

For income tax purposes, depreciable capital assets are grouped into classes. Capital cost allowance (depreciation) is then calculated at prescribed rates on a declining balance basis. Only one-half of the normal capital cost allowance rate is used on the net additions to a class for any particular year. Net additions are determined by subtracting from the cost of new assets the proceeds of disposal, up to the original cost, of any assets of the same class that were traded-in or otherwise disposed of during the year. The table on the next page shows the use of the capital cost allowance system.

You should note that if all assets in a class have been disposed of, any remaining balance may be written off. This is referred to as a terminal loss. On the other hand, if the proceeds from the disposal of assets result in a negative balance in the class, this amount gets included in income as recaptured depreciation.

Depletion

Canada Revenue Agency refers to woodlots as “timber limits,” in other words a treed area of land. The cost of a “timber limit” includes the cost of the underlying land and may also include the cost of surveys, cruises, maps, and so on. The total cost - less the residual value of the land and the cost of surveys, cruises, maps, etc. - is depleted when trees are harvested. A deduction for depletion, based on quantity harvested, is calculated by multiplying this “net cost” of the timber by the quantity of wood harvested and dividing by the quantity of timber in the limit as shown by a cruise. A further deduction – equal to one-tenth of the cost of surveys, cruises, maps and so on - is allowed until their cost has been fully deducted.

For example, let’s assume a woodlot owner is beginning to harvest a timber limit. The owner’s cost of the timber limit is $55,000 of which $8,500 is applicable to the residual value of the land. In addition, $5,000 has been incurred for cruises, surveys, etc. The cruise indicated there were 2,500 cords of timber in the limit of which 625 were harvested during the year. In the example below we show how to calculate the deduction for depletion of the timber limit.

Basic deduction:

= (Cords harvested / Cords documented by cruise) X (cost of timber limit less residual value of land)

= (625/2500) X ($55,000 - $8,500)

= $11,625

Additional deduction re: cost of cruises, surveys, etc.

= Total cost thereof X 1/10

= $5,000 x 0.1

= $500

Total depletion deduction for the year is $12,125.

Exercise 5

In 2007, Ian purchased 150 acres of land for $45,000. The bare land value of the land is $15,000. Prior to purchasing, he had the woodlot cruised, which indicated that the woodlot contained 2,400 cords of wood. In 2008 he purchased a used ATV for $9,000 and a used wood splitter for $2,000. In the fall he cut and sold 18 cords of stud wood and 6 cords of firewood.

A) Assuming a capital cost allowance of 30% for the ATV and 20% for the wood splitter and that he bought the ATV for 75% business use and 25% personal use, what deduction can he make for his equipment purchases in 2008?

B) How much can he claim for depletion of the land?

There is an alternative method of claiming depletion for a timber limit in which the lesser of $100 and the amount received in the year for the sale of timber is allowed as a deduction. This method obviously has limited application and benefit, but may apply where the timber resources have not been documented by a cruise.

Inventory

The cost of seedlings and planting represent the cost of inventory for tree farmers, and, for cash basis taxpayers, these costs would be deductible as paid. The CRA’s position appears to be that these costs do not represent “purchased inventory” subject to the mandatory inventory adjustment. This means that even if there is a loss in the year, the cost of seedlings and planting do not need to be added back. Remember, however, that cash basis farmers can also smooth or average their income by adding to income an amount up to the fair market value of their inventory. For accrual basis taxpayers, these costs would be carried forward and deducted against future revenue. Harvesting costs (including depletion of timber limits for non-farmers) would be treated the same way. If the taxpayer operates woodlots but generally not as a farmer, the costs of seedlings and planting would become part of the cost of the timber limit.

Maintenance and operating costs

Annual maintenance costs such as thinning and spraying should be fully deductible as incurred or as paid, depending on which accounting method you use. Other costs such as labour, equipment operating and maintenance costs, property taxes, office supplies, and marketing expenses would also be deducted as incurred or as paid.

Vehicles – what can I deduct?

Vehicle operating costs incurred for earning income can also be deducted to determine your net income. Some of these costs include, lease payments, interest on loan to purchase car, repairs, insurance, fuel and so on. Again, depending on which method of accounting is used, they are either deducted when they are paid or become payable.

The rules for the deductibility of vehicle expenses differ whether the business is operated as a proprietorship or a corporation and whether the corporation owns the car or the individual does.

In a proprietorship, if the vehicle is also being used for personal purposes, appropriate adjustments should be made to the expenses claimed by the owner. Total expenses would be prorated between business versus personal use, based on a mileage log.

If vehicles used personally are owned by a corporation, taxable benefits will be assessed for personal use. On the other hand, if vehicles are personally owned and used in the corporation, the corporation can pay out a tax- free allowance on a reasonable per kilometre basis to reimburse you for business kilometres. The mileage allowance is deductible to the company and is deemed to include HST. There are various restrictions on the expenses that can be claimed based on the type of vehicle and its business versus personal use. You should consult your accountant to discuss and advise you in this area.

Interest and taxes

Interest and property taxes are deductible expenses provided they are incurred to earn income from a business or property. Although there may not be revenue in a given year, if a woodlot is held mainly with the intent to produce income, then interest and property taxes should be deductible.